Hello Readers,

Welcome to the next edition of #MovenAroundTheGlobe. I just walked off the stage here at #FinovateFall2017 in New York and I’m really excited to share my latest update with you all.

With our HQ down in Fulton Center (near Wall Street), it’s always great to return to where it all began for Moven. I was able to swing by our office this morning to say hello to the New York team and take a few meetings with my colleagues. During my commute this morning, I realized what a great time it is to be in the big apple – the weather is great and the business is booming! After a busy morning in the office, I set my sights upon Finovate for even more meetings. It was a long day but I came away with many opportunities and learnings.

The East Coast of the USA is one of the most influential regions for the FinTech industry. New York specifically presents a unique opportunity for young FinTechs due to its proximity to one of the most highly recognized financial centers on the planet. With this in mind, FinovateFall in New York is one of the hallmark events of the year.

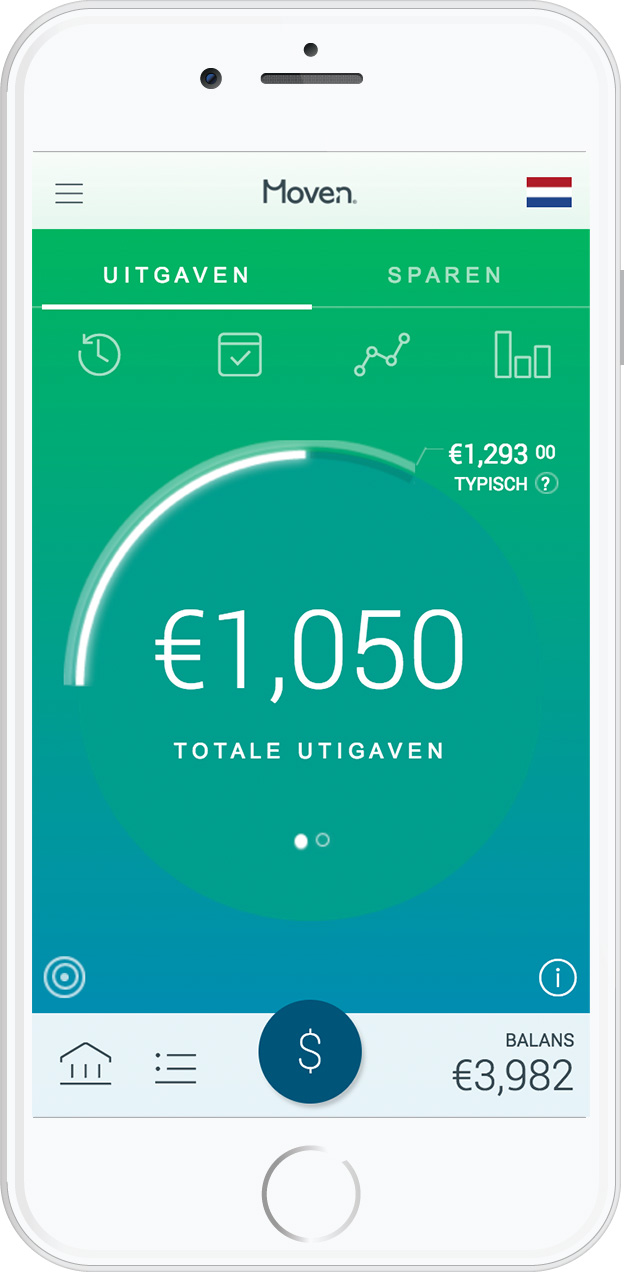

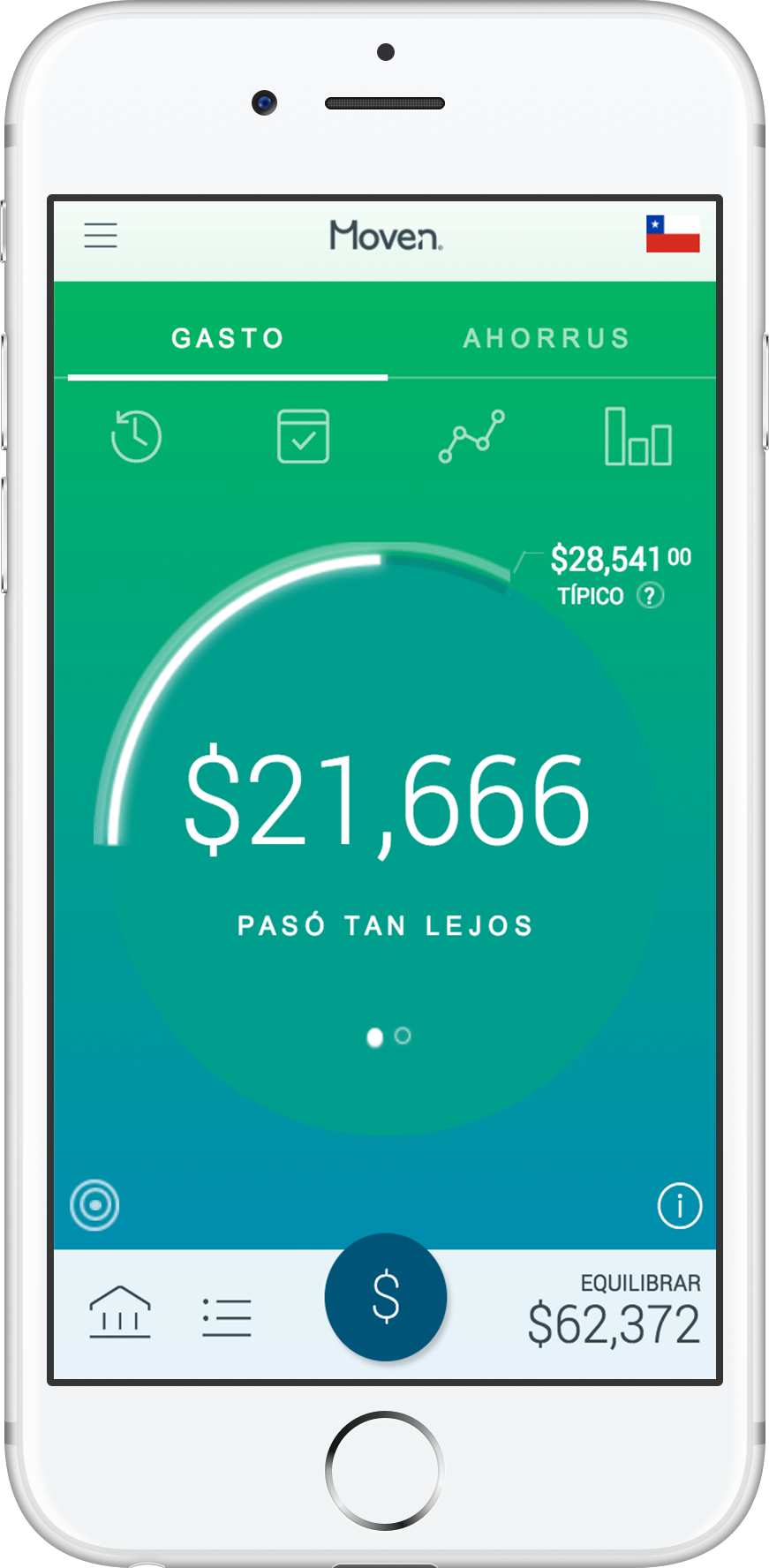

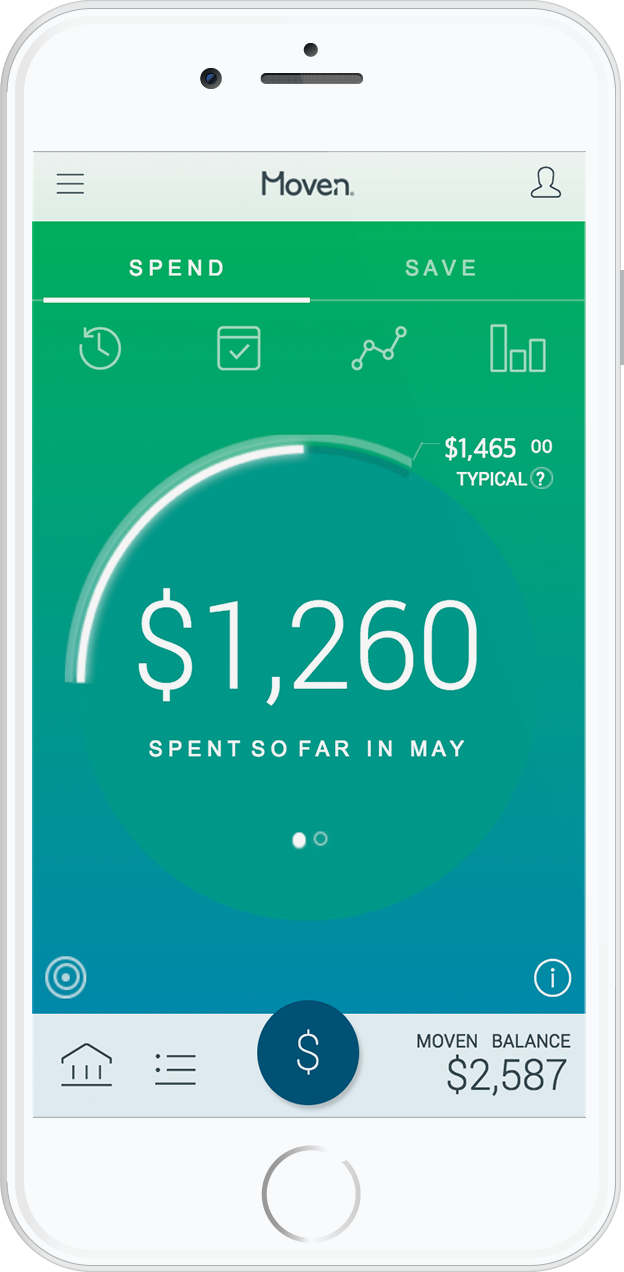

Reflecting before our presentation, I realized how well we’ve been doing this year with over 1.3m users in our platform. Our partnership with TD also speaks volumes to me about our growth as a platform, as they have shown a 4-8% reduction in discretionary spend among frequent users of the TD MySpend app. Additionally, those users were 7x less likely to attrit. On top of that, we have seen phenomenal success with the release of our Stash Savings functionality. Without any paid advertising or interest offered, more than 25% of users opened a savings account. Bearing that in mind, my colleague, Ryan, and I were incredibly excited to demo our new ChatUI at Finovate. (If you missed our demo at Finovate, you’re in luck because the video is still up on our periscope channel: https://www.pscp.tv/w/1lPKqwoplVeJb. Don’t miss our Founder & CEO, Brett King, at the end!)

After we left the stage, we were fully booked with interviews and meetings. It was great to hear from other attendees how Moven is still showing that we are ahead of the curve with the release of our newest functionality. It was also a great to see how the savings product resonated with all of the financial institutions we met at the event.

Lastly, I want to quickly send a shout out and big thank you to my team for helping us make Finovate such a great success. I couldn’t have done it without you!

The next stop on my journey will be Buenos Aires, Argentina! Be on the lookout for my next post, “#MovenAroundTheGlobe: Buenos Aires”, on the blog soon!

Until next time,

Morten Kriek

VP EMEA

Moven Enterprise